THE CHALLENGE

Legacy bank systems that put the brakes on both internal processes and the customer experience

The experience of buying an electric car online, from payment to delivery, is all-important for Carla's team. Their mission is to make it as easy as buying clothes online, and the team saw that efficiently moving and managing money behind-the-scenes is a key enabler for this. Carla’s critical treasury and payment operations include:

- Collecting and reconciling incoming payments

- Monitoring bank statements for incoming transfers to manage inventory

A big headache for Carla's operations team was their inability to access transaction data in real time, since the legacy bank interfaces they relied on didn't allow it. Team members had to manually log into online bank portals and check whether specific payments had been credited to their accounts line-by-line. Unsurprisingly this process resulted in delayed payment notifications – delays that meant customers often had to wait additional days to receive their cars.

Carla’s business model is margin-based, as opposed to being credit-driven, and to continuously optimize inventory the team needed an overview of incoming and outgoing money flows across all banks. Not being able to retrieve cash flow data programmatically, in real time, and access it in one central place was a big miss. For the finance team, using multiple bank interfaces meant reconciliation was inevitably a highly manual process.

For a rapidly growing scale-up like Carla, having to divert engineering resources to building direct bank connections and maintaining an internal back-office system was an increasingly tough pill to swallow. Instead the Carla team committed to finding a future-proof solution that would integrate with their existing ecommerce platform.

THE SOLUTION

Fully automated liquidity monitoring and faster money movement

Carla partnered with Atlar to leverage pre-existing bank connections, monitor cash flow data in real time, and automate payment status tracking and notifications. The engineering team integrated the Atlar API within two weeks of signing the contract – delivering time-savings for the broader company and an improved customer experience overnight.

Carla's operations team are now immediately notified as soon as a payment is credited to one of their accounts with the transaction automatically matched to the underlying order. This means there's no need to continuously monitor bank portals for new payments and customer orders can be confirmed faster.

The Carla team went one step further in streamlining the customer experience. Using Atlar's transaction webhooks, Carla built a workflow whereby upon receiving a payment the car is automatically approved for delivery and a notification is sent simultaneously to the buyer. Today 100% of Carla's customers are notified when their order is confirmed in real time – and the cars themselves are delivered days earlier in some cases.

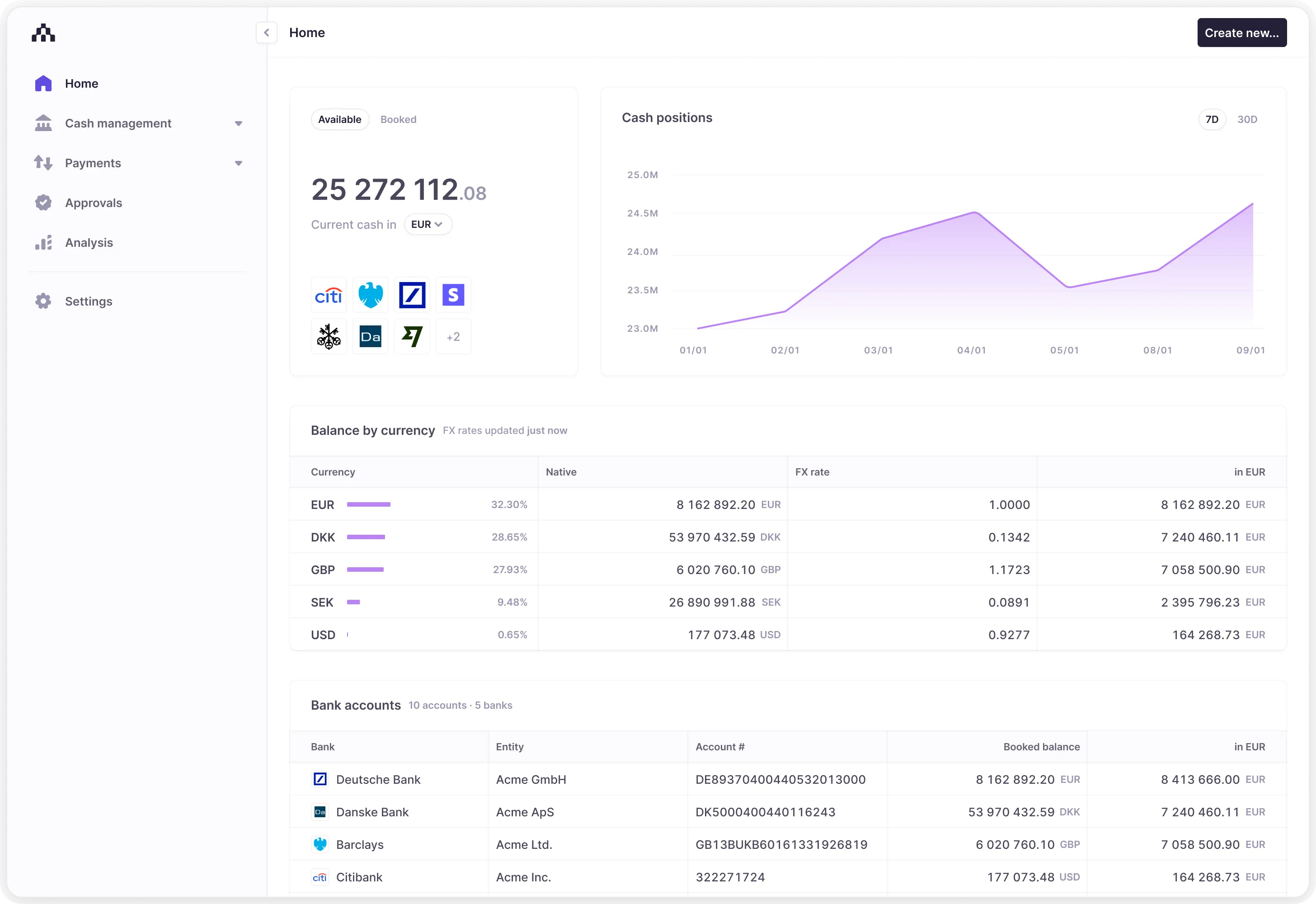

These efficiency gains extended to internal processes too. Carla's finance team now use the Atlar dashboard to monitor liquidity across banks, gaining a level of visibility over real-time cash inflows and outflows that would previously have taken hours. Similarly, since consolidated bank data is now piped into their internal system in real time, they could build ledger logic to automatically reconcile payments and track outstanding balances for partially paid invoices.

THE RESULT

Streamlined processes that drive ongoing customer satisfaction gains

The Carla team isn't short of ambition – they're set on becoming a European category leader in electric vehicles and are on course to do exactly that. They needed a partner that was equally agile and could support them in quickly scaling their treasury infrastructure.

The partnership already began delivering results in a few short weeks with faster internal processes leading directly to an improved experience and higher customer satisfaction scores.

"The fact that Atlar came pre-integrated with our banks, could offer real-time cash flow monitoring, and automated our payment notifications has saved us both time and engineering resources while improving customer satisfaction," said Mustafa. "We're excited to continue working with the Atlar team."

If complex payment and treasury operations are slowing your team down, book a demo and take the Atlar platform for a 30-minute test drive yourself.