THE CHALLENGE

Reliable, real-time bank data was the missing piece of the jigsaw

Luxembourg-based fundcraft has come a long way since its launch in 2021, scaling to more than €5 billion in assets under administration and working with private equity and venture capital firms across Europe. Most importantly, the fully licensed platform has brought a new level of transparency and efficiency to the world of investment operations.

‘fundcraft was founded on the realization that there were systemic issues in the fund services industry,’ says Thomas, Head of Product Operations at fundcraft. ‘Traditional providers tend to operate in silos that don’t talk to one another. Even their own teams don't share tools or databases.’

Thomas and the team set out to truly centralize all back-office fund operations in one platform. Crucially, this also unlocks a whole new way of working for their customers. There’s no need for several points-of-contact, constant back and forth, and an entire in-house coordination team.

‘One of our biggest strengths is that asset managers can access any data or report any time, from anywhere, since we integrate with all third parties,’ adds Thomas. ‘Bank data is crucial to this, there can be several banking partners and multiple currencies per fund.’

The only way fundcraft could access bank data was by exporting files from an external tool that had to be reconciled with their accounting system. It was an ongoing, highly manual task just to provide customers with usable cash reports at the end of the month. The two systems even used different date formats that had to be manually reconciled line by line.

In short, fundcraft lacked an efficient, scalable way of accessing key bank data like transactions and cash balances. The process caused headaches for the team but also risked impacting the customer experience by not having data accessible when it’s needed. For Thomas and the team, it was fundamentally out of step with the commitment to real-time visibility and usability that sets fundcraft apart.

‘Customers rely on our platform as both a single source of truth and operations hub, where they can view the latest information on a fund and take action,’ says Thomas. ‘We saw that feeding all relevant bank data to our platform automatically, in real time, would unlock full transparency and control end-to-end, setting us apart from siloed, legacy systems even further.’

THE SOLUTION

Full visibility over all cash balances and transactions at any bank, in real time

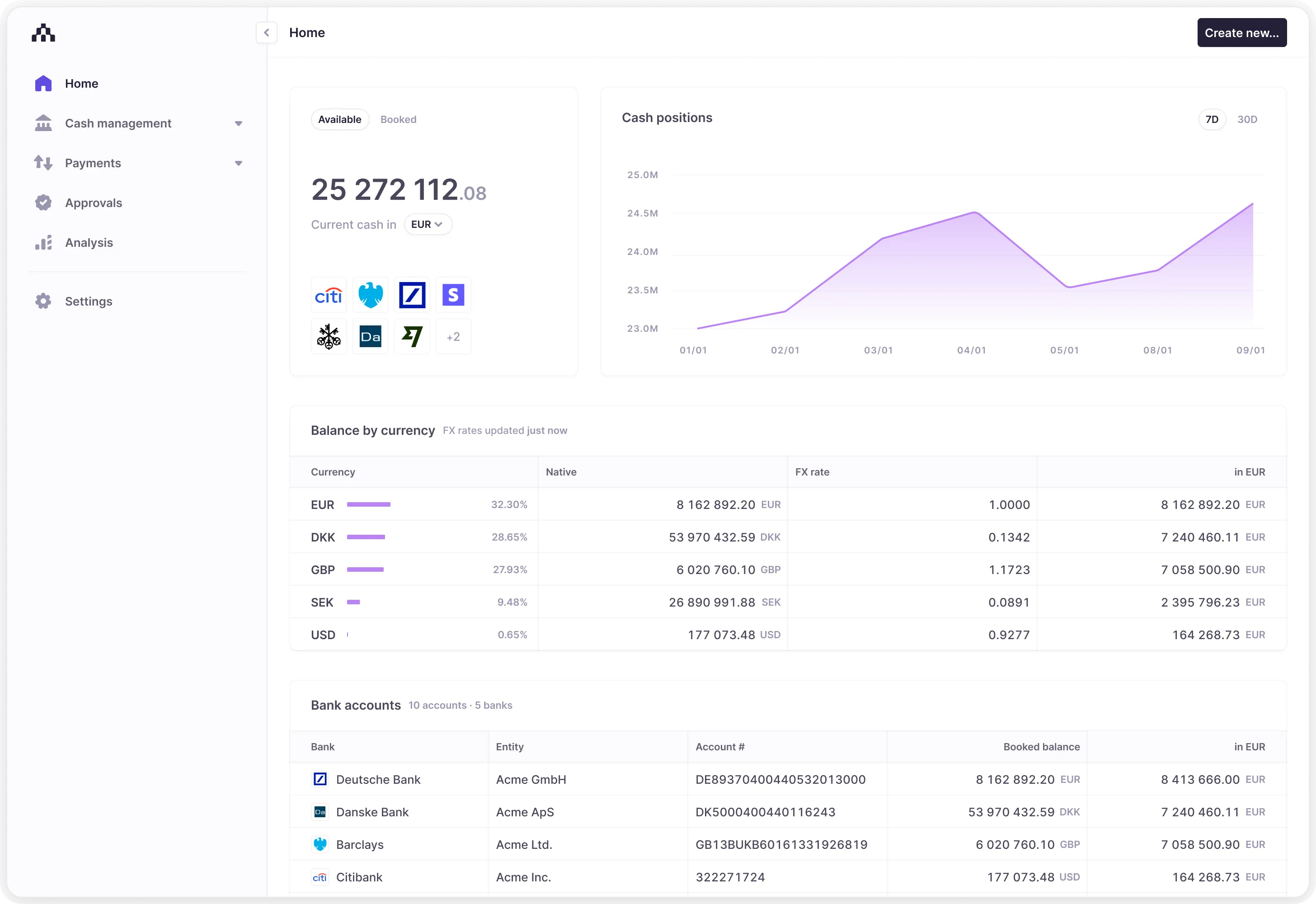

fundcraft partnered with Atlar to connect multiple banks and service providers in a matter of weeks and provide normalized, usable data to customers in real time. Now fundcraft customers can see inflows and outflows on demand, monitor transactions round the clock, and trigger workflows without ever leaving the platform.

fundcraft had been using an external system to access its bank data and initiate payments that couldn’t be synced with its platform. The team had to manually download and reupload bank statements from their online banking portals and CSV files from their accounting software. It was a time-consuming and error-prone process. Now all balances and transaction data from multiple banks are consolidated in the Atlar dashboard and immediately available in the fundcraft platform through the Atlar API.

Having data fully synced between systems has drastically simplified reconciliation. Relying on manual CSV uploads occasionally led to inconsistencies between bank data and the information in fundcraft’s accounting system. This cost considerable time to troubleshoot on top of the time taken to extract and move the files themselves. Now any and all money movement to or from the platform is automatically reconciled with bank statements available in real time, saving the team several hours each week.

Perhaps most importantly, fundcraft customers can now access cash balances and transactions relating to their funds on demand, 24/7, 365 days a year. Previously the back-office team would need to manually generate a cash report for each customer at regular intervals.

This was a cumbersome process in itself but crucially one that was inconsistent with the team’s vision of full transparency and enabling customers to self-serve. fundcraft had achieved this for every other aspect of a fund’s operations, and now the platform displays real-time bank data from any account, in all currencies, in clean and easy-to-use dashboards.

‘Today our users see a complete 360-degree view of their fund’s information in our dashboard,’ says Thomas. ‘While other systems are still essentially manual, we are digitalizing the back-office work that goes into operating a fund, including portfolio management and accounting. In terms of accounting, we’ll have a tech leverage of around 85% by the end of 2024. Connecting our clients' bank accounts through Atlar is a key enabler of that.’

THE RESULT

Faster back-office operations, regained time, and a seamless customer experience

Quickly scaling businesses require payment and treasury operations that can easily flex to accommodate more customers, markets, and banks. fundcraft’s rapid growth to over 100 alternative investment funds, representing more than €5 billion in assets, left its back-office processes stretched with more and more hours spent on manual, error-prone work. The team’s goal was to recoup the time being spent on administrative tasks, level up the customer experience, and increase data accuracy in the process.

‘Before the team had to do a series of manual tasks on a daily, weekly, and monthly basis that had zero added value,’ says Thomas. ‘With Atlar this work is now totally automated.’

The immediate availability of balance and transaction data in the platform has another benefit beyond time-savings and greater focus for the team. Customers can now access cash reporting on demand, whenever they want. By empowering customers with easier and faster access to their fund’s data, the fundcraft team has leveled up the overall experience.

‘Asset managers can get more done inside the fundcraft platform and avoid the manual back and forth they’re used to with other fund service providers,’ adds Thomas. ‘That has been the real game-changer, and why we’re so excited about this. It saves time and removes friction for our customers.’

fundcraft and other modern teams switch to Atlar to set themselves free from legacy bank systems and manual treasury work. To see the Atlar dashboard for yourself, book a demo.